PORTFOLIO COMPANY NEWS

Sequential Brands Group Announces Second Quarter Results and Financial Update

Q2 revenue of $4.3 million vs. $1.0 million in prior year quarter

Q2 adjusted EBITDA of $2.5 million, representing a 57% adjusted EBITDA margin

Company projects revenue of $23-25 million over the next twelve months

Company completes capital raise of $44 million to bolster acquisition strategy

New York, NY - July 31, 2013 – Sequential Brands Group, Inc. (OTC: SQBG) ("Sequential" or the "Company") today announced financial results for the second quarter ended June 30, 2013.

Second Quarter 2013 Results:

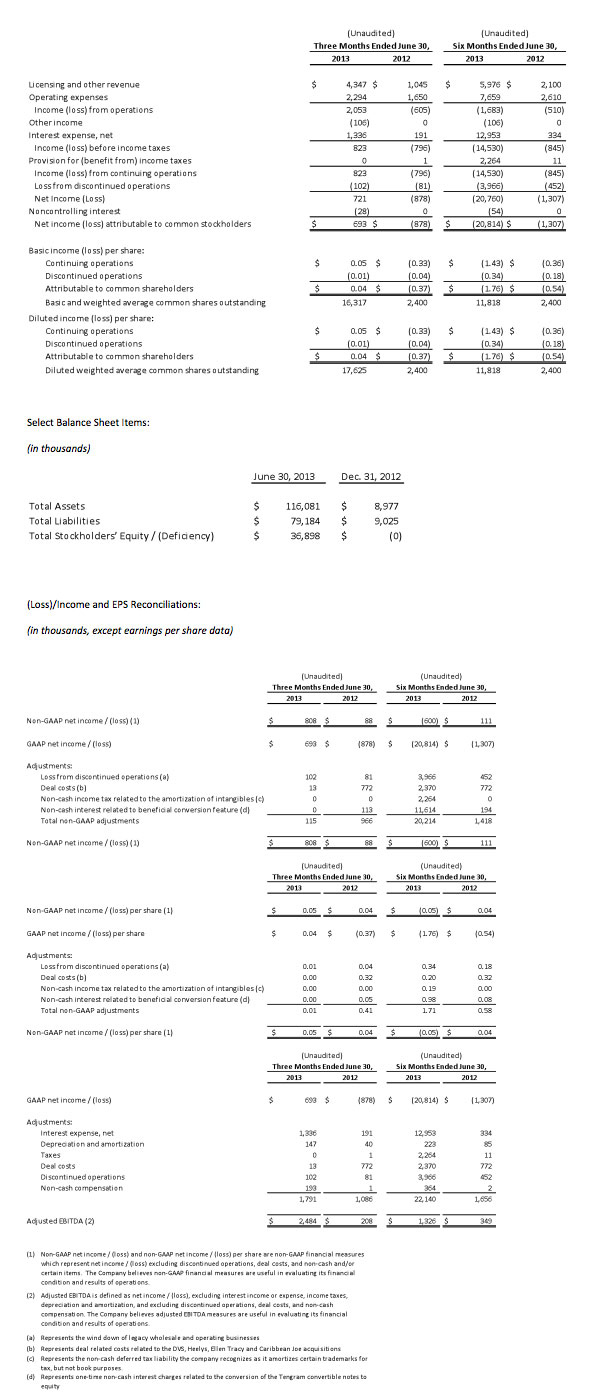

Total revenue from continuing operations for the second quarter that ended June 30, 2013 increased to approximately $4.3 million, as compared to $1.0 million in the prior year quarter. Adjusted EBITDA for the second quarter was approximately $2.5 million, as compared to $0.2 million in the prior year quarter. On a non-GAAP basis, net income for the quarter was $0.8 million or $0.05 per share, as compared to $0.1 million or $0.04 per share the prior year quarter and on a GAAP basis, net income for the quarter was $0.7 million or $0.04 per share, as compared to a net loss of ($0.9) million or ($0.37) per share the prior year quarter. See tables below for reconciliation of GAAP to non-GAAP measures.

Yehuda Shmidman, Sequential's Chief Executive Officer, stated, "We are pleased with our second quarter results and encouraged by the overall progress that we have made since we converted to a license model last year. Year to date, we have doubled our brand portfolio from three brands to six brands, assembled a team of best-in-class brand management professionals to drive organic growth, and we have positioned our company with a powerful balance sheet to execute on our brand acquisition strategy. It is an exciting time for Sequential Brands Group."

Gary Klein, Sequential's Chief Financial Officer, added, "Our financial results for the second quarter were in line with management's expectations and are more reflective than prior quarters of the new business model we began last year. In addition, with the completion of our recent $44 million private placement of our common stock, we have over $57 million of cash on our balance sheet to help fuel our growth strategy."

June Year-to-Date 2013 Results:

Total revenue from continuing operations for the six months ended June 30, 2013 increased to approximately $6.0 million, as compared to approximately $2.1 million, for prior year period. The Company's adjusted EBITDA was $1.3 million as compared to approximately $0.3 million for the six months ended the prior year and the Company's non-GAAP net loss was approximately $0.6 million, or approximately ($0.05) per share, for the six months ended June 30, 2013, as compared to net income of approximately $0.1 million, or approximately $0.04 per share, in the prior year. Net loss on a GAAP basis was approximately $20.8 million for the six months ended June 30, 2013, or ($1.76) per share, as compared to approximately a net loss of approximately $1.3 million, or approximately ($0.54) per share, in the prior year quarter as the Company incurred certain costs in the first quarter of 2013, both cash and non-cash that were either not representative of the Company's ongoing business or were unusual in nature. See tables below for reconciliation of GAAP to non-GAAP measures.

Financial Update:

The Company projects revenue of $23-25 million over the next four quarters. As previously stated, the Company expects revenue for 2013 to be weighted to the fourth quarter due to seasonality in the businesses of many of the Company's licensees.

See reconciliation tables below for non-GAAP metrics. These non-GAAP metrics may be inconsistent with similar measures presented by other companies and should only be used in conjunction with our results reported according the U.S. GAAP. Any financial measure other than those prepared in accordance with U.S. GAAP should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

Notes:

Management will provide further commentary today, July 31, 2013 on the Company's financial results via a pre-recorded call. These remarks will be available via telephone and webcast replay beginning at approximately 4:30 p.m. ET. To access the pre-recorded comments, please dial 973-409-9606. Webcast replay will be accessible via the Company's investor relations page at www.sequentialbrandsgroup.com.

ABOUT SEQUENTIAL BRANDS GROUP, INC:

Sequential Brands Group, Inc. (SQBG) owns, promotes, markets, and licenses a portfolio of consumer brands that presently include William Rast®, People's Liberation®, DVS®, Heelys®, Caribbean Joe® and Ellen Tracy®. Sequential seeks to ensure that its brands continue to thrive and grow by employing strong brand management, design and marketing teams. Sequential has licensed and intends to license its brands in a variety of consumer categories to retailers, wholesalers and distributors in the United States and in certain international territories. For more information, please visit Sequential's corporate website at: www.sequentialbrandsgroup.com. To inquire about licensing opportunities, please email: newbusiness@sbg-ny.com.

FORWARD LOOKING STATEMENTS:

Certain statements in this press release and oral statements made from time to time by representatives of the Company are forward-looking statements ("forward-looking statements") that involve risks and uncertainties. For this purpose, any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. When used in this press release and in documents referenced herein, forward-looking statements include, without limitation, statements regarding our expectations, beliefs or intentions that are signified by terminology such as "subject to," "believes," "anticipates," "plans," "expects," "intends," "estimates," "may," "will," "should," "can," the negatives thereof, variations thereon and similar expressions. Such forward-looking statements reflect the Company's current views with respect to future events, based on what the Company believes are reasonable assumptions; however, such statements are subject to certain risks, uncertainties and other factors. Our actual results may differ materially from those anticipated in any forward-looking statements due to known and unknown risks, uncertainties and other factors. The section entitled "Risk Factors" set forth in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2012, in Item 1A of Part II of our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2013 and in similar discussions in our other Securities and Exchange Commission filings, discuss some of the important risks, uncertainties and other factors that may affect our business, results of operations and financial condition. The Company's stockholders are urged to consider such risks, uncertainties and factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. The Company is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT:

Gary Klein, gklein@sbg-ny.com

Chief Financial Officer