PORTFOLIO COMPANY NEWS

October 5, 2016 - Differential Brands Group is getting into the swim of things.

The brand management firm acquired Scandinavia-based footwear label Swims in July, with plans to ramp up its North American presence.

"We're moving some of the functions to the U.S. [because] we see the U.S. as untapped opportunity," Differential CEO Michael Buckley said. "Swims had a Canadian distributor that was running [its U.S. business, but to be successful here] you need to be 'boots on the ground' with a management team that understands the U.S."

Buckley's first step toward building a more U.S.-centered executive team was to tap former Sanuk chief Jake Brandman to serve as the new president of Swims.

"[Brandman] is a strong merchant and sales professional with a long track record of successfully building great brands and cultures, " said Buckley, who hired Brandman in August. (In addition to his tenure at Deckers Brands-owned Sanuk, Brandman has also worked at Teva, Vans and Keen Footwear.)

As part of his accelerated growth strategy, Buckley said he believes Swims' U.S. wholesale business can grow "dramatically."

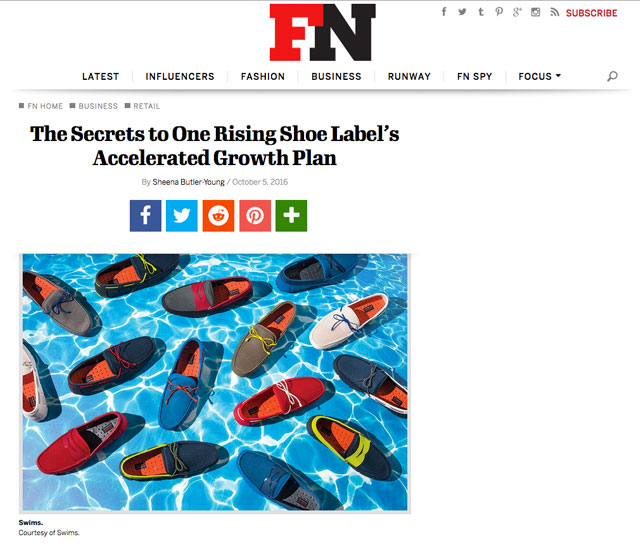

Swims, known for its galoshes and boat shoes, is sold in 400 doors in the U.S. — including Neiman Marcus and Nordstrom.

"On the footwear side, we will build product across both genders, and we will focus on making it an all-year-long type of product range," Buckley said. "Today, it's more of a resort and spring/summer business. We want to [add] fall and winter [footwear]."

Nevertheless, Kevin Eisenberg, senior buyer at Canada-based luxury men's department store Harry Rosen Inc., said the brand has already been a hit year-round at the chain — with black and navy galoshes selling well into the winter months.

"Swims are sought out by a diverse spectrum of [our] clients," Eisenberg said. "They are entry-priced in our matrix, and our experience is that customers often buy multiple pairs every season."

Swims' customer base is 70 percent male and 30 percent female, but Buckley said he's looking to change that, too.

"Long term, we think it should be 50-50," Buckley said.

Since its January debut, Differential Brands — the product of a transaction that merged Robert Graham and Hudson Jeans and sold off predecessor firm Joe's Jeans — has made omnichannel growth a priority, and Buckley said Swims would be no exception.

"Each of our brands does about 20 percent of their business online — that's a combination of the company's website and other retailers' websites," he explained. "Our goal is for all of our brands to generate 15 percent of their total brand volume on their [own] websites."

Despite the challenges plaguing the brick-and-mortar channel — many retailers have scaled down their store counts in recent months — Buckley said the firm plans to launch branded stores for Swims. Differential's chief said he's considering a 1,000- to 1,500-sq.-ft. layout that he'll test in a few locations before a major rollout.