PORTFOLIO COMPANY NEWS

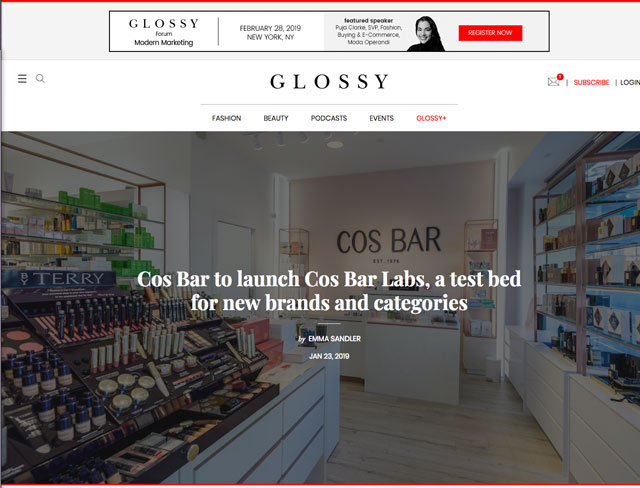

Cos Bar, the multibrand luxury beauty retailer founded in 1976, is launching a new in-store and online initiative called Cos Bar Labs, which will let the company experiment with new brands, products and categories.

Beginning in the first quarter of 2019, Cos Bar will highlight three to five brands at a time that are new to the retailer. They will be featured in dedicated in-store displays at six locations (including La Jolla, California; Brentwood, California; and New York City) and in a new section on CosBar.com. While testing time frame and sales quota for a brand will be determined on a case-by-case basis, the idea is that successful brands will be able to expand to more Cos Bar locations. (There are 20 standalone stores.) Among included companies will be clean beauty brands like Indie Lee and Kosas, essential oil brand Vitruvi and British hair-care brand Philipe Kingsley.

Cos Bar Labs emerged from Cos Bar's ongoing partnership with Banana Republic, which launched in October 2018 and entails a shop-in-shop in the clothing retailer's San Francisco flagship. The goal is to test new categories, like home and wellness, but also to dig deeper into current categories like makeup in order to reach younger customers. Cos Bar's current customer base is 35- to 55-year-old women with a high expendable income.

"Brick-and-mortar has a historically bad rap for being slow moving, but in brick-and-mortar's defense, it's harder to move brands in and out compared to digital," said David Olsen, CEO of Cos Bar. "Cos Bar Labs gives us the ability to play in [new] areas, but we stick with brands positioned in the luxury [sector]."

Cos Bar's approach to omnichannel and emerging beauty is reminiscent of how other luxury retailers are attempting to keep pace with the deluge of change taking place within the category. Neiman Marcus launched a task force in January 2018 that was partially dedicated to finding brands that were in newer beauty segments like CBD, while Saks Fifth Avenue launched an apothecary wellness section in 2015 that is now available at 24 locations. Meanwhile, Ulta and Sephora have both been heavily focused on facilitating easier shopping experiences between channels, with each retailer directly crediting this approach as a way to grow their respective businesses.

Cos Bar Labs will also grow the company's e-commerce presence, according to Olsen. In 2015, e-commerce accounted for 2 percent of company sales, before reaching 15 percent in 2018. Digital sales are expected to hit 30 percent in the next three to five years, he said.

"[Cos Bar Labs] is an opportunity to tip us more toward digital penetration. Customer acquisition online [is driven by] newness and uniqueness, as well as exclusivity," he said. "The customer is getting more demanding by the minute, but we are up to the challenge [to] give them the best experience."

Cos Bar, while requires all brands to provide training to its staff at least twice per year, plans to rely on its high-touch in-store education, as well as online editorial content (in the form of videos, Q&A's with brand founders and features) to help support the Cos Bar Labs push. In-store events with brand founders will also be a key way for brands to find success at Cos Bar, said Olsen.

"It will be a great learning experience for us. If a [brand is] a win, then we will expand it to more stores, but if not, we will at least learn," he said.