PORTFOLIO COMPANY NEWS

History Rhymes: Sequential Brands Group Could Be

Iconix Brands All Over Again

New York - May 21, 2014

Summary

– Many members of Sequential (SQBG)'s management team were part of Iconix (ICON)'s transition to a brand-management business and were key to Iconix's success over the last half decade.

– The brand-management business model is a quality business model that can lead to a lot of value accretion with talented management.

– Sequential is in its early stages as a brand-manager and many investors might overlook it for its past earnings.

– We believe that Sequential is undervalued and upcoming acquisitions this year could surprise the market and provide a catalyst in the short term.

Value investors are always trying to find a good price, but oftentimes they overlook quality businesses because they aren't willing to pay up for quality management and an above average business model. It is even harder to be a step ahead of other investors by finding these quality companies while in their infancy before they experience huge growth.

Thankfully, history often rhymes. If we are good at picking up these patterns, then we might be a few steps ahead of Mr. Market. We think Sequential Brands Group (SQBG)'s management and board is rhyming the success they achieved while at Iconix Brands (ICON). Each company's beginnings are almost identical and have many of the same players that helped Iconix transform into the business it is today. Investors in Sequential could be getting a very high quality business in its infancy and if patient, could benefit from high value accretion for many years to come. The market has started to notice Sequential's potential since its investor presentation in March; however, the company continues to be under followed, and we believe that management's acquisition and earning projections are conservative. Any acquisitions this year could surprise the market providing a catalyst for value in the short term.

History and Business Model

Sequential Brands Group is a company that has changed its name and business model in the past couple of years. In 2011, the company was operating under the name People's Liberation as a designer, marketer, wholesaler and retail operator of branded apparel and accessories. The company mainly produced high priced denim jeans that began to lose popularity during the financial crisis. The company was able to survive after receiving a $14.5 million capital infusion from the private equity firm Tengram Capital Partners. People's Liberation changed its name to Sequential Brands Group and opted to change its business model for the better. Sequential used the excess cash to acquire other brands and transition from a traditional apparel retailer to a brand-management and licensing business. The company chose this method based on the success Iconix Brands had achieved, and it is no surprise this is the business model that was chosen because the managing partner of Tengram Capital William Sweedler as well as Sequential CEO Yehuda Shmidman, and CFO Gary Klein previously worked at Iconix Brands.

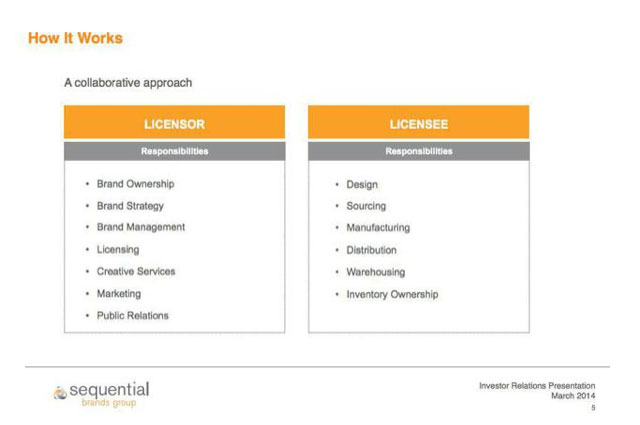

The beauty of a brand management business is many fold, but first let's take a look at what a licensor's responsibilities are.

Owning brands and licensing them is a much better business model than trying to own a brand and manufacture/sell the product. Brand licensing is a model that is very similar to a franchising model where the company owns the brand, sets the strategy through marketing, and gets a licensing fee in return. They hand off all the capital-intensive and risky duties to the licensee. Licensing also has the benefit of guaranteed minimum revenues based on contractual agreements leading to sticky revenues. Unlike a franchiser, however, brand licensing does not have high turnover store openings and closings since licensees are large companies and not individuals.

The brand-management business model is very asset-light since there is no need to invest money into inventory. Inventory risk is no longer the licensor's worry and returns on capital can be greater than 100% while operating margin and net-margins can be quite high at 60% and 30%, respectively (Iconix numbers). Since there is little need for capital re-investment, large portions of cash flows can be given directly back to shareholders via share repurchases, dividends or acquisitions in other brands. Sequential Brands is following an almost identical path that Iconix took in 2004. Sequential is focusing on allocating capital towards acquiring quality brands that can be expanded. Later, as the company matures, Sequential is most likely to then allocate capital towards share repurchases when deals are harder to find.

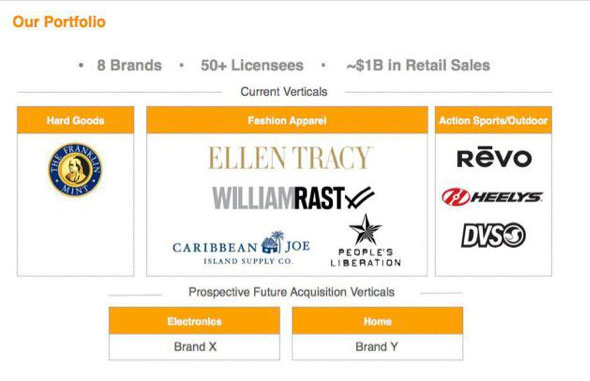

Growth from a brand management business model can be attained through two avenues, either through organic growth — expanding in new markets, categories, new channels — or by acquisitions of other brands. What really piques our interest is that brand-management companies can easily scale their operations through acquisitions. This model is not too different from another company called Platform Specialty Products (PAH) and Jarden (JAH). PAH and JAH have highly scalable business models focused on acquiring companies in different verticals and building them up. Sequential Brands currently licenses fashion apparel brands, hard goods and action/sports and outdoor brands. The company can acquire brands in its current verticals which benefit from synergies. Each new vertical the company acquires sets the platform for further brand acquisition, and synergies are possible from marketing current brands. The other verticals Sequential has mentioned that might be a potential in the future are electronics and home brands, but there could potentially be more. Below is Sequential's current portfolio.

Since an investment thesis for investing in PAH and JAH hinges largely on chairman Martin Franklin and each company CEO's ability to add value through organic growth and acquisitions, Sequence Brands Group also must have the proper management in place to add value in acquisitions. We believe that Sequential has the right group of individuals in place that have the experience to succeed in the brand-management strategy. Sequential Brand's CEO Yehuda Shimdman, CFO Gary Klein and chairman William Sweedler share something in common, years of experience working at Iconix Brands. All three gentlemen started working at similar times around Iconix's (then called Candie's Inc.) crucial transition from a manufacturer of apparel to a brand-manager in 2004 and 2005.

Both Yehuda Shimdman and Gary Klein came to Iconix in 2005 and worked their way up the business. Shimdman came to Iconix with a wealth of experience at a start-up called Earthbound which specialized in licensing brands. There he worked on many transactions but most notably helped to pitch the deal that brought a fashion line from Isaac Mizrahi to Target in 2003. At Iconix, he worked his way up to COO of the company and was involved in many initiatives related to a number of brand acquisitions. His experience at both Earthbound and Iconix are directly transferable and we like that he has been a part of many brand transaction deals. Gary Klein worked his way up to VP of finance at Iconix in 2008.

The mastermind behind Sequential Brands' turnaround, however, can largely be attributed to William Sweedler. It was his firm Tengram Capital Partners that invested the capital to allow Sequential Brands to survive and transition itself into a brand-manager. It makes sense because Sweedler has had an extensive history of brand-management prior to being a director on Iconix's board as well as CEO and president of Iconix's fully owned subsidiary Joe Boxer. Previously, he was the CEO of Windsong Allegiance Group, which was a diverse brand marketer and developer. During his time there he notably led the acquisition, restructuring and sale of Joe Boxer to Iconix and various other branded companies. Now as the chairman of Sequential Brands, we feel Sweedler's role is not too far from the role that Martin Franklin has with Platform Specialty Products and Jarden, who is a very valuable resource for acquisitions and brand growth.

We feel that the combination of these three men and their experiences greatly enhance the probability that Sequential Brands will succeed in adding value while acquisitions of brands are made. Management and the board are also properly incentivized with their total ownership equaling 32.9% of the company. A majority is owned by Sweedler's Tengram Capital, but Yehuda Shimdman owns 1.2% of the company.

Valuation and Iconix Case Study

Serial acquirers in their beginnings are extremely difficult to value since we do not know exactly how much value accretion the company's future acquisitions will have and their timing. Value then largely rests on the shoulders of the quality of the management, the supply of quality brands for sale, and management's ability to acquire those brands for good prices.

Normally management with good track records, and a quality business model will trade at a high price. Sequential Brands is no different and a quick look at the valuation shows that the market is putting a premium on the company. The company's valuation has recently spiked up after the shareholder presentation and currently does not trade at any multiple that would be deemed a fair price. Shares trade at 8.5x sales, at an EV/EBTIDA of 15x and creates virtually no cash yet. The main thing, however, is that Sequential Brands is just starting and value is not in the rear view mirror but in the future. The company is growing fast and has $25 million in cash for acquisitions. The company went from practically no sales in 2011 to $22 million in 2013. First quarter net income was 4x higher than last year. So, is the market really putting a ridiculous premium on the company? We think not, because Sequential's goals are achievable and if achieved, the company would be worth much more in the future than today.

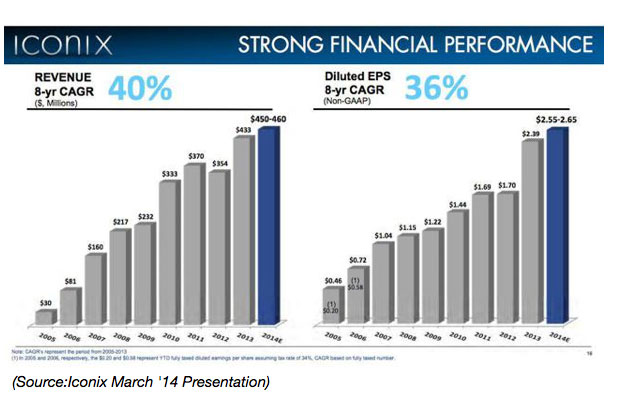

Management feels that they can comfortably acquire two to three brands a year for the next three years and estimate revenues to grow to $30 million this year and $100 million three years out. We think this is an achievable goal since Iconix was able to grow from $30 million at the end of its first year as brand-manager to $160 million by its third year of its transformation.

It is no coincidence that Sequential is following an identical path Iconix had in its beginnings. Sequential actually might be better positioned than Iconix. Sequential currently has eight brands; compare that to Iconix's five brands by the end of 2005 when it achieved $30 million in revenues. That means Sequential has a more diversified revenue base than 2005 Iconix, which would provide less risk.

Although the share price of Sequential has risen dramatically since the investor presentation in March, the company remains under-followed and the market is basing its projections off of Sequential management's conservative projections. Note that management indicates their three-year goal is to have 12-14 brands which does not really make sense with their acquisition goal. With eight brands currently, and an estimated two to three acquisitions a year for three years, that would indicate 14 to 17 brands by the end of three years. We believe Sequential is setting the market up to believe that there will be no acquisition in 2014. This would also indicate that management is conservative in their acquisition goals. Looking back at Iconix's history, they were able to acquire four brands in 2006 and four brands in 2007. We feel that an acquisition, or two, this year would provide a catalyst for a higher valuation.

One caveat of our comparison with 2005 to 2007 Iconix is that Iconix had the benefit of the housing bubble, so that might have fueled extra revenues. That is why we think that Sequential is forecasting lower acquisition and revenue goals. Additionally, the economy in the U.S. continues to improve and Sequential has been performing well with its strategy of expanding its markets overseas. Take for instance the launches of William Rast in Europe and the expansion of Ellen Tracy in Asia, particularly South Korea.

If Sequential management is able to achieve $100 million or more in revenues at the end of 2016, then it is likely that the company is undervalued. Using Iconix's historical operating margins of 60% and net margins of $30 million, then Sequential could be generating $30 million after-tax or about $45 million pre-tax (33% tax rate) in three years. A fair price a businessman might buy the company for in three years could be $450 million or 10x pre-tax earnings. The current enterprise value is $260 million which would equal a 20% CAGR over a three-year period and assumes that the market in 2016 is not too optimistic about Sequential's future growth prospects and does not put a higher multiple on the company.

Yehuda Shimdman said a 4 times debt to EBITDA multiple will be their target. Compare that with Iconix's 5.5 multiple in 2007. Sequential would likely have about $240 million in debt by the end of 2016 with debt at a 4 times EBITDA multiple; we assume $60 million in EBITDA, which is below their $70 million estimate. We estimate net debt to be around $200 million with $40 million in cash, which would indicate a market cap of $250 million or only about 7% higher than today's price. Since growth rarely is bought for cheap after the fact, we think the valuation could be much higher. To illustrate, at the peak of the housing bubble in 2007 Iconix had a market cap of $1.2 billion with $600 million net debt for an EV of $1.8 billion. That would have been 18.75 times pre-tax earnings. We doubt that the market will be as rosy with Sequential in 2016, unless of course there is another economic bubble, but the company could trade at a higher multiple than 10 times. At 12 times pre-tax earnings, the company would be trading at an enterprise value of $540 million or a market of $340 million. That would lead to a 13% CAGR over the three-year period.

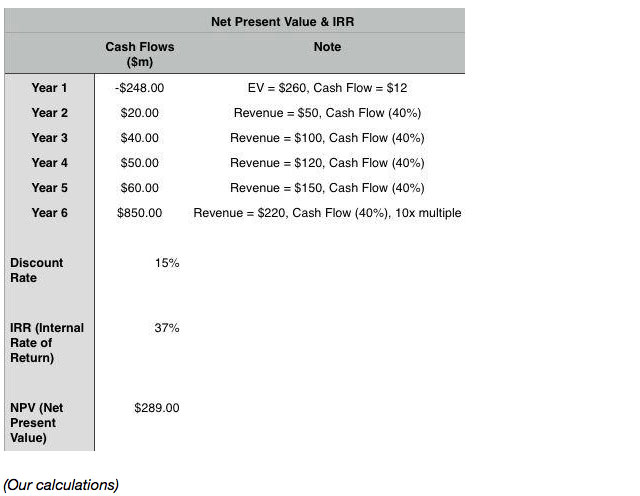

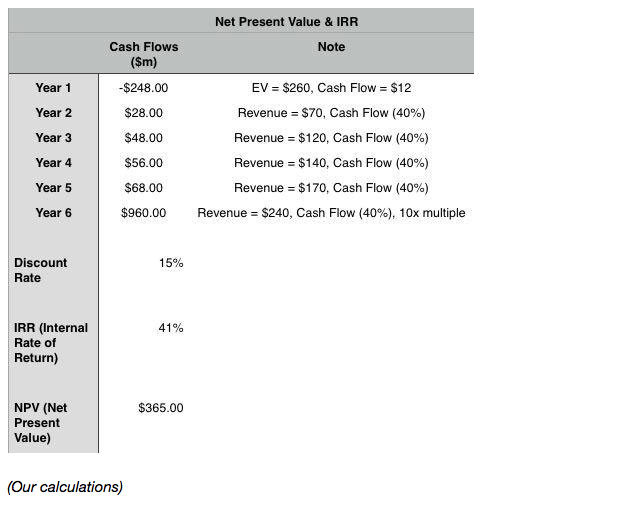

A net present value calculation of future cash flows while buying the whole company can further give us an idea of what the market is expecting for Sequential. Iconix in its early beginnings achieved a free cash flow margin of about 40% of revenue and we expect Sequential to have similar levels. Future cash flows for the next six years could be as follows:

We assume that revenues could reach $220 million in the sixth year, which is much less than the $330 million Iconix generated in its sixth year. Also, this would assume we could sell the whole business at the end of the six-year period for $850 million, which is roughly 10x pre-tax earnings. Such a case would indicate that shares are trading at a 11% discount to the NPV of our discounted cash flows.

Since we feel the above revenues are conservative and it is possible the company acquires an additional one to two brands this year, we think that the following might be a slightly more optimistic case:

In the slightly more optimistic case, Sequential would be trading at a 28% discount to its net present value.

Forecasting usually can get people in trouble with overly optimistic projections, but we feel that management is being conservative in their estimates of brand expansion and their acquisition targets. Regardless of our esoteric projections, we think the quality of the business and the quality of the management is worth much more than the current valuation and could accrete value higher than the market over the long term. The market could potentially be overlooking the fact that management's acquisition goals are most likely conservative and a few acquisitions this year could lead to a higher share price. Outside investors could look back at Sequential's current valuation years from now and kick themselves for not investing, but investing isn't without risk.

Risks

Brand-management creates a lot of cash flow that is diverted to acquisitions and other value-accretive endeavors. Management usually do not worry too much about the price of acquisitions or the price shares are repurchased at and more often than not destroy value. Sequential Brands Group's management could misallocate capital with their acquisitions and destroy value, which would lead to long-term capital loss. We believe that Sequential's management and board are highly skilled in brand-management strategies, are properly incentivized, and have a track record of creating value at Iconix and other endeavors.

The current brands that Sequential has acquired could turn out to be of lower quality than anticipated and future brand expansion could be sub-par. We believe that Sequential's larger brand portfolio, when compared to Iconix's early portfolio, provides for more diversification and lower risk.

A low supply of potential brands to acquire could inhibit Sequential's ability to grow by acquisitions. There are many licensors with plenty of brands, but there does not seem to be any indication that the licensor industry is spinning off smaller brands like the specialty chemical industry is. We think that Sequential's team has set achievable targets for acquisitions and have the industry experience as well as network contacts to have access to acquisitions.

Catalysts

– The growing U.S. economy and global economy could lead to brand expansion from the company's current brand portfolio. Such expansion could lead to greater revenues than expected, which would lead to a higher share price.

– One or two acquisitions this year could surprise the market leading to a higher share price in the near term.

Conclusion

Sequential Brands Group is looking almost identical to Iconix Brands when it was first transitioning from an apparel manufacturer to a brand manager. The brand-management business strategy is a business model that has the characteristics that long-term investors look for, sticky revenues, asset light operations and high cash flows that can be allocated in value-accretive ways. It just takes years of careful value-accretive acquisitions to create a diverse portfolio of quality brands. Management has to be very adept in acquiring companies and growing their brands. Sequential has a management team and board that have the value accretive acquisition experience, track record and the proper incentives in place to achieve long-term value. A traditional value investor would overlook this hidden gem, but we feel that the current market valuation is undervalued. It is highly likely history could be rhyming itself and that Sequential Brands Group could be following Iconix Brands' path of market beating returns over a long period.

Disclaimer

This is not meant as a recommendation to buy or sell and is only for instructional purposes. At the current moment we do not own shares in SQBG, ICON, or JAH but this could change at any point in the future. We do own PAH.

About the author: Unconventional Capital Wisdom

I'm the managing member of Unconventional Capital Wisdom, LLC which is a registered investment advisor in New York. We help individuals stand out from the crowd and achieve long-term investment results that have the best chance of being above average. I also write about the acquisition of worldly wisdom at www.ElementaryWorldlyWisdom.com.